Top 25 Sales Intelligence Tools For B2B Companies (2026)

Sales intelligence platforms help B2B teams identify the right accounts, understand buying intent, and engage prospects with better timing and context. What started as simple contact databases has evolved into a broader category of sales intelligence software that combines B2B data, enrichment, intent signals, and workflow integrations.

If you’re researching a sales intelligence platform for the first time, this guide will help you understand:

- what sales intelligence tools actually do,

- which platforms are most commonly shortlisted, and

- how to choose the right tool based on your GTM motion.

Table of Contents

- TL;DR: Sales Intelligence Tools by Category

- What Is a Sales Intelligence Platform?

- What to Look for in Sales Intelligence Tools

- 25 Sales Intelligence Platforms: Features & Pricing Breakdown

- 1. Bitscale

- 2. ZoomInfo

- 3. Cognism

- 4. LinkedIn Sales Navigator

- 5. Apollo

- 6. Demandbase (formerly Insideview)

- 7. 6sense

- 8. Leadfeeder (Dealfront)

- 9. Breeze - Hubspot (Former - Clearbit)

- 10. Lusha

- 11. Kaspr

- 12. Datanyze

- 13. Crystal

- 14. Lead411

- 15. Vainu

- 16. Hunter

- 17. HubSpot Sales Hub

- 18. Seamless

- 19. Drift (Salesloft)

- 20. UpLead

- 21. Bombora

- 22. D&B Hoovers

- 23. DemandScience

- 24. Winmo

- 25. LeadIQ

- Best Sales Intelligence Tools by Use Case

- How to Choose the Right Sales Intelligence Platform

- Frequently Asked Questions (FAQs)

TL;DR: Sales Intelligence Tools by Category

- Execution-layer platforms (data → enrichment → activation): Bitscale, Apollo

- Enterprise B2B databases: ZoomInfo, D&B Hoovers

- Intent-first & predictive ABM platforms: 6sense, Demandbase, Bombora

- LinkedIn-led prospecting workflows: LinkedIn Sales Navigator, Kaspr, LeadIQ

- Lightweight contact tools (credit-based): Lusha, Lead411, Seamless

- Email-first verification tools: Hunter, UpLead

What Is a Sales Intelligence Platform?

A sales intelligence platform is software that helps B2B sales teams discover, enrich, and prioritize accounts and contacts using external data and buying signals. Unlike CRMs - which store pipeline activity - sales intelligence tools help teams decide who to contact, when to reach out, and why now.

Most modern sales intelligence tools include:

- contact and company data (emails, phones, firmographics),

- enrichment to fill missing CRM fields,

- intent or activity signals (hiring, funding, research),

- integrations that push insights into sales workflows.

What to Look for in Sales Intelligence Tools

When shortlisting B2B sales intelligence platforms, focus on:

- Data quality & coverage: Does the tool reliably cover your ICP by region, industry, and company size?

- Enrichment depth: Can it enrich multiple attributes (not just email and phone) at scale?

- Intent & signals: Does it surface signals that indicate buying readiness, not just static data?

- Workflow & activation: Does intelligence flow into your CRM and outbound tools, or stay locked in dashboards?

- Pricing transparency: Is pricing predictable as usage scales, or dependent on opaque annual contracts?

25 Sales Intelligence Platforms: Features & Pricing Breakdown

1. Bitscale

Bitscale treats sales intelligence as an execution layer, not just a database. It combines lead sourcing, multi-source enrichment, intent signals, and AI-driven research - then activates that data directly into outbound and CRM workflows.

Key features

- Lead sourcing from web and structured data

- Multi-provider enrichment (emails, phones, revenue, headcount, tech, hiring)

- Waterfall enrichment logic

- Intent signals (hiring, funding, activity-based triggers)

- AI research agent for account insights

- CRM and outbound integrations

Pricing

- Lifetime free plan

- Transparent, usage-based paid plans

- No mandatory annual contracts

Best for: Outbound GTM teams, RevOps, and agencies building repeatable outbound systems

2. ZoomInfo

ZoomInfo is one of the most widely used sales intelligence platforms, offering a large B2B contact and company database with enrichment and account insights.

Key features

- Extensive B2B contact and company data

- Org charts and account hierarchies

- Firmographic and technographic data

- Intent data via add-ons

- CRM integrations

Pricing

- Custom, quote-based pricing

- Typically high annual contracts

- Add-ons increase total cost

Best for: Enterprise teams with standardized GTM processes

3. Cognism

Cognism focuses on compliant B2B data, with strong coverage in EMEA and GDPR-regulated markets.

Key features

- GDPR-compliant emails and mobile numbers

- Company intelligence and enrichment

- CRM integrations

Pricing

- Custom annual pricing

- No public self-serve plans

Best for: Teams selling in regulated regions

4. LinkedIn Sales Navigator

Sales Navigator is best known for people intelligence - helping sellers understand who works where and how organizations are structured.

Key features

- Advanced LinkedIn search filters

- Buyer and account mapping

- Job change and activity alerts

- InMail messaging

Pricing

- Starts around $99 per user/month

- Advanced plans are sales-led

Best for: Relationship-driven and account-based selling

5. Apollo

Apollo combines prospecting data with outreach features, making it a popular choice for SMB outbound teams.

Key features

- Contact and company database

- Email sequencing and dialer

- Basic enrichment

- CRM sync

Pricing

- Free plan available

- Paid plans scale with usage

Best for: SMB teams launching outbound quickly

6. Demandbase (formerly Insideview)

Demandbase is designed for account-based GTM strategies, focusing heavily on intent and engagement signals.

Key features

- Account-level intent data

- Buying group insights

- ABM analytics and reporting

Pricing

- Enterprise-only, custom pricing

Best for: Mature ABM programs

7. 6sense

6sense uses predictive analytics to identify in-market accounts and map them to buying stages.

Key features

- Predictive intent modeling

- Account prioritization

- Revenue analytics

Pricing

- Enterprise-only pricing

Best for: Large revenue teams running intent-led GTM

8. Leadfeeder (Dealfront)

Leadfeeder reveals which companies visit your website, even if they don’t fill out a form.

Key features

- Company-level website visitor tracking

- Page-level engagement insights

- CRM integrations

Pricing

- Free limited plan

- Paid plans based on traffic volume

Best for: Turning anonymous website traffic into warm leads

9. Breeze - Hubspot (Former - Clearbit)

Breeze - Hubspot (Former - Clearbit), is commonly used as an enrichment layer for inbound and PLG workflows.

Key features

- Firmographic and technographic enrichment

- Lead scoring and routing

- Marketing automation integrations

Pricing

- Usage-based API pricing

Best for: Marketing ops and PLG teams

10. Lusha

Lusha is a lightweight tool focused on quick access to contact data.

Key features

- Emails and direct dials

- Browser extension

- CRM export

Pricing

- Free tier available

- Credit-based paid plans

Best for: SDRs needing fast contact access

11. Kaspr

Kaspr is a LinkedIn-focused prospecting tool that helps reps capture verified B2B contact data (emails and phone numbers) while browsing profiles - often used as a lightweight add-on to Sales Navigator-style workflows.

Key Features

- LinkedIn Chrome extension + contact capture

- Email and phone credits + exports

- Basic workflows and integrations (varies by plan)

Pricing

- Free plan available; paid plans typically start around $49/user/month (varies by billing).

Best for: LinkedIn-heavy SDR teams that want fast contact capture without a full platform swap.

12. Datanyze

Datanyze is best known for technographic and prospecting insights - helping teams identify companies by the tools they use and uncover contact details via extension-based workflows.

Key Features

- Technographic insights (what tools a company uses)

- Prospecting via Chrome extension

- Credit-based reveals / exports

Pricing

- Public plans commonly listed around $29/month (Pro 1) and $55/month (Pro 2).

Best for: Prospecting by tech stack (e.g., “companies using X”) with lightweight contact reveals.

13. Crystal

Crystal provides personality insights to help sellers tailor outreach and conversations - useful when your team wants better response rates through communication style matching.

Key Features

- DISC/personality insights for prospects

- Writing guidance and meeting prep

- LinkedIn-related workflow (varies by plan)

Pricing

- Free plan; Premium commonly listed at $49/month.

Best for: Teams that already have leads but want better conversion through personalization.

14. Lead411

Lead411 is a B2B contact + company data platform that emphasizes verified data and prospecting workflows (often positioned as a value-friendly option in the sales intelligence category).

Key Features

- Contact + company database with verification

- Filtering + lists + exports

- Chrome extension; intent-related capabilities mentioned in positioning

Pricing

- Public messaging indicates plans starting around $49/month, with annual seat-based options shown in pricing listings.

Best for: SMB/mid-market teams that want a database + exports without enterprise pricing.

15. Vainu

Vainu is a data platform used heavily for company intelligence and enrichment (notably strong in Nordic/European datasets), often used by sales + RevOps for keeping records fresh.

Key Features

- Company & contact data (region strength varies)

- CRM/RevOps enrichment workflows

- Exports/API options

Pricing

- Pricing references commonly start around €350/month (billed annually) (with plan structure varying).

Best for: EMEA/Nordics-focused prospecting and enrichment with strong company datasets.

16. Hunter

Hunter is a go-to tool for finding and verifying professional email addresses at scale - often used as a lightweight enrichment layer for outbound.

Key Features

- Email finder + verification

- Domain search and discovery

- Outreach/sequences options (plan-dependent)

Pricing

- Public plans; common market references place Starter around $49/month (varies by billing).

Best for: Email-first outbound teams needing verification and deliverability support.

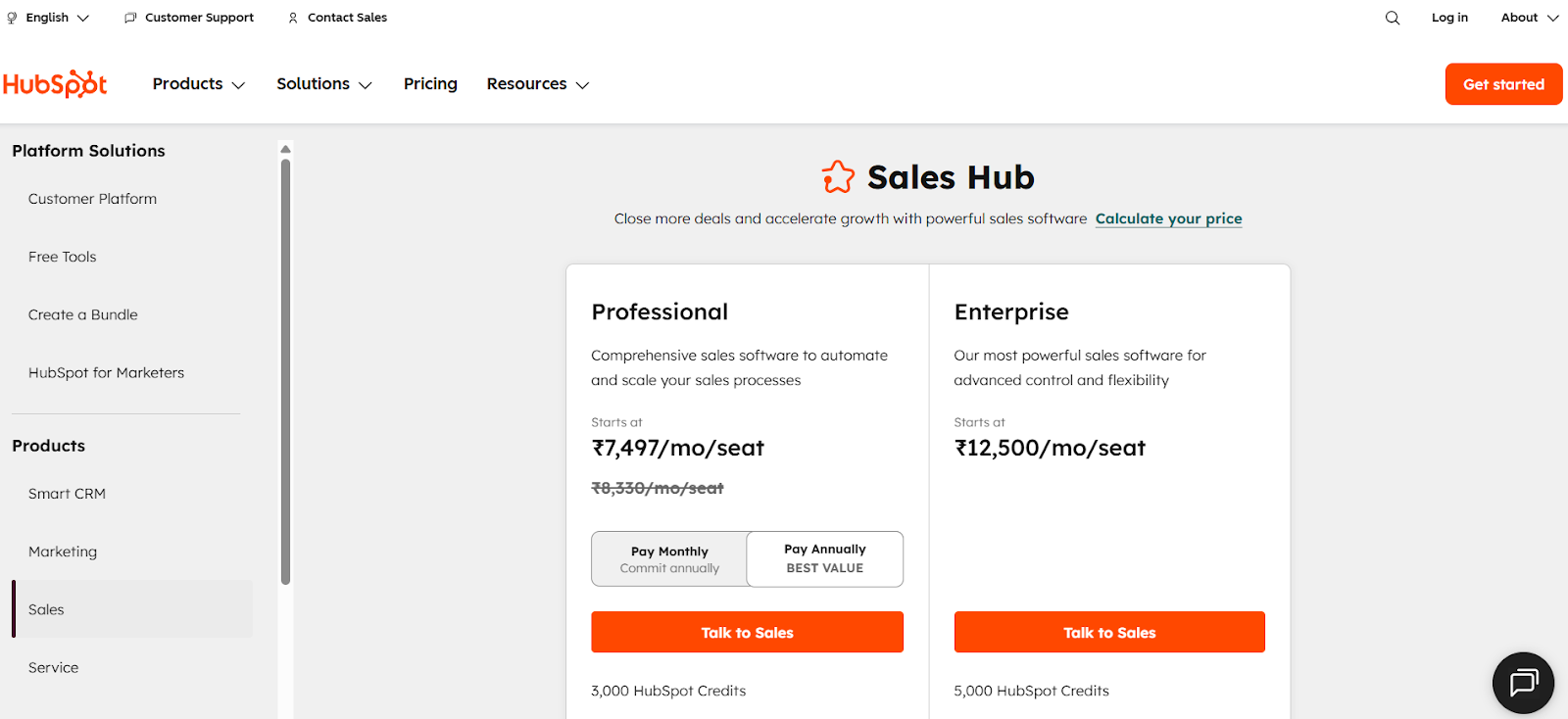

17. HubSpot Sales Hub

HubSpot Sales Hub combines CRM-driven selling workflows with prospect tracking, sequences, and pipeline management - often chosen when a team wants sales execution plus light “intel” inside the CRM environment.

Key Features

- CRM + pipeline + sales automation

- Sequences, tracking, and reporting (by tier)

- Tight integration with HubSpot ecosystem

Pricing

- Sales Hub Starter pricing commonly listed at $9/seat/month (annual) or $15/seat/month (monthly).

Best for: Teams that want sales execution + reporting inside HubSpot, not a separate data stack.

18. Seamless

Seamless is a prospecting platform positioned around AI-assisted lead discovery and contact finding, typically using a credit model.

Key Features

- Contact discovery + enrichment workflow

- Credit-based lookups/exports

- CRM-related workflow messaging (varies by plan)

Pricing

- Free access described up to 50 credits; commonly cited starting pricing around $147/month billed annually for basic tiers (higher tiers quote-based).

Best for: Teams that want fast list building with an AI-prospecting angle.

19. Drift (Salesloft)

Drift is a conversational buyer engagement platform that turns website traffic into pipeline by qualifying visitors, routing, and booking meetings - often used as a “signal + conversion” layer rather than a database.

Key Features

- Website chat + qualification

- Meeting booking and routing

- Integrations with common GTM stacks (varies)

Pricing

- Typically enterprise/quote-based; market estimates often place annual spend in the $10k–$150k/year range depending on scale and features.

Best for: B2B companies converting high-intent website visitors into booked meetings.

20. UpLead

UpLead is a sales intelligence and data enrichment tool focused on verified B2B contact data and credit-based exports - commonly used for list building and enrichment.

Key Features

- Contact + company database

- Verification emphasis (positioning varies)

- Enrichment + exports (plan-dependent)

Pricing

- Commonly cited starting point around $99/month for entry plans (credits included).

Best for: Teams that want verified exports for outbound without enterprise contracts.

21. Bombora

Bombora is a leading B2B intent data provider, known for surfacing which accounts are researching topics relevant to your product - often used to prioritize ABM and outbound targeting.

Key Features

- Company-level intent signals (topic consumption)

- Audience and identity solutions

- ABM prioritization inputs

Pricing

- Typically custom/quote-based (intent data usually sold via packages and integrations).

Best for: ABM and RevOps teams who want “in-market” prioritization signals.

22. D&B Hoovers

D&B Hoovers is a B2B data and company intelligence platform used for prospecting, firmographic research, and list building - often shortlisted by enterprise and mid-market teams.

Key Features

- Company and contact intelligence

- Prospecting and list building

- Integrations and exports (varies by plan)

Pricing

- References commonly cite an Essentials plan around $49/month, with enterprise tiers quote-based.

Best for: Teams that want structured company intelligence and prospecting at scale.

23. DemandScience

DemandScience is positioned around B2B demand generation and data-driven marketing outcomes (often used as a pipeline acceleration layer with data + programs).

Key Features

- B2B data + demand programs (offering varies)

- Pipeline-focused outcomes messaging

- Enterprise delivery model

Pricing

- Pricing is typically not publicly listed and generally handled via sales conversations.

Best for: Teams that want managed demand programs + data at scale (not self-serve list building).

24. Winmo

Winmo is a sales intelligence platform focused on advertising/marketing spend and decision-maker intelligence - popular with agencies, adtech, and sponsorship sellers.

Key Features

- Decision-maker and org intelligence in marketing spend

- Sales signals around brands/agencies

- Targeting and account insights

Pricing

- Commonly listed starting price around $9,995/year (packages/tiers vary).

Best for: Agencies and ad/sponsorship sellers targeting marketing decision-makers.

25. LeadIQ

LeadIQ is a prospecting workflow tool (not just a database) designed to capture contacts from LinkedIn and other sources, reduce manual entry, and push clean leads into your CRM/outbound stack.

Key Features

- Prospect capture + enrichment workflow

- Chrome extension; list building

- CRM push + reduced manual data entry

Pricing

- Pricing page shows Free; Pro from $15/month; Enterprise is “contact us.”

Best for: SDR teams who live in LinkedIn and want faster “capture → CRM → sequence” flow.

Best Sales Intelligence Tools by Use Case

How to Choose the Right Sales Intelligence Platform

Instead of asking “Which tool is best?”, ask:

- Do we need data only or data plus execution?

- Is our GTM motion outbound, ABM, PLG, or RevOps-led?

- How easily does intelligence turn into real outreach?

Frequently Asked Questions (FAQs)

1. What is a sales intelligence platform?

A sales intelligence platform helps B2B teams discover, enrich, and prioritize accounts and contacts using external data and buying signals. It supports better targeting, timing, and personalization in sales outreach.

2. Is sales intelligence software the same as a CRM?

No. A CRM manages pipeline, deals, and sales activity, while sales intelligence software helps teams find prospects, enrich missing data, and identify signals before and during outreach.

3. Do sales intelligence tools include intent data?

Many modern sales intelligence tools include intent signals such as hiring activity, funding events, website visits, or topic research. However, the depth and accuracy of intent data varies by platform.

4. Which sales intelligence tool is best for outbound sales?

Outbound teams typically benefit most from tools that combine lead sourcing, enrichment, and activation - so intelligence turns directly into sales-ready lists and workflows rather than static data exports.

5. How do B2B companies choose the right sales intelligence platform?

B2B companies should evaluate sales intelligence platforms based on data quality, enrichment depth, intent signals, CRM integrations, pricing transparency, and how well the tool fits their GTM motion (outbound, ABM, or PLG).

6. Are sales intelligence tools only for large enterprise teams?

No. While some platforms focus on enterprise use cases, many sales intelligence tools are designed for SMBs, startups, agencies, and mid-market teams - especially those running outbound or RevOps-led motions.

7. What’s the difference between sales intelligence and sales engagement tools?

Sales intelligence tools focus on who to contact and why, using data and signals. Sales engagement tools focus on how to contact, handling sequences, calls, and follow-ups. Many teams use both together.

8. Can sales intelligence platforms help with account-based marketing (ABM)?

Yes. Many platforms support ABM by surfacing account-level insights, buying signals, and engagement data that help teams prioritize accounts and coordinate sales and marketing efforts.

9. Do sales intelligence tools replace LinkedIn Sales Navigator?

Sales intelligence tools don’t replace LinkedIn Sales Navigator. Instead, they complement it by adding emails, phone numbers, enrichment, intent signals, and workflow automation that LinkedIn alone does not provide.

10. Is a free sales intelligence tool enough to get started?

Free plans can be useful for testing workflows and basic prospecting, but most teams eventually upgrade to paid plans to access deeper enrichment, higher data volumes, and advanced signals.